Getting your tax right when moving from the UK to Spain requires an understanding of all the things that need to be done and when to do them. Here we provide information about all the things you may need to do or consider to make sure you get your tax right both on the UK side as a leaver and on the Spanish side becoming tax resident in Spain.

Things you may need to do to get Your Tax Right Before Moving from the UK to Spain

Check Capital Gains Tax (CGT)

Selling assets before leaving could have tax implications. UK property remains subject to CGT even if you are non-resident. Conversely, assets such as your main home which are exempt from CGT in the UK, could get caught in Spanish CGT if sold around the time or after your move to Spain.

Personal Pensions, ISA’s and Investments

Growth in personal pensions such as SIPP’s is subject to CGT annually and ISA’s lose the tax status that they offer to you as a UK resident. Anyone who has these type of financial assests should get professional advice on getting their financial affairs optimised for Spanish tax before becoming tax resident.

Tax Planning Advice

Seek expert help to optimise tax efficiency, especially for pensions, investments, and property.

Understand Ongoing UK Tax Obligations

Although Spanish residents are liable for tax in Spain on all income including that arising in the UK, there are some exceptions and types of income that continue to be taxed in the UK.

For example, pensions from Government employment, such as police, local authority, teachers NHS etc, under the double tax agreement are only taxed in the UK. Income from letting property must have any tax due in the UK settled first, but may also be taxed in Spain, if the amount of tax due in Spain is higher than that already paid in the UK. In this case you pay the difference in Spain.

Aside from the above and income from employment while physically present in the UK, all other personal income is no longer liable for UK tax once you are tax resident in Spain.

If you receive rental income, you will need to register as a Non-Resident Landlord and continue submitting a tax return in the UK as a non-resident.

Notify HMRC that you have left the UK

Once you have left the UK, you should notify HMRC by completing form P85. You can submit form P85 to notify that you left the UK. If you have a Government Gateway ID you can do this online.

https://www.gov.uk/government/publications/income-tax-leaving-the-uk-getting-your-tax-right-p85

If you are bringing personal possessions such as household goods or a car to Spain as part of you move, you can apply for a customs duty and VAT exemption. The customs tax office will usually accept proof of notifying HMRC of leaving the UK, amongst other docs, to grant a waiver.

National Insurance (NI) Contributions

Consider Voluntary NI Contributions: If you plan to claim a UK State Pension in the future, you may want to continue making Class 2 or Class 3 contributions if you don’t alreayd have the maximum years of contributions.

Getting Your Tax Right After Moving from the UK to Spain

Get a Digital Certificate

A digital certificate is an electronic document that verifies a person’s identity online. It functions like a digital ID card and is used to authenticate users, encrypt data, and digitally sign documents, ensuring secure online interactions with public administrations, banks, and businesses. A bit like the UK’s Government Gateway ID.

Having a digital certificate in Spain provides several benefits, including:

>Secure Online Identification, – Allows individuals to authenticate themselves securely in online transactions with public and private entities.

>Electronic Signatures – Enables legally valid digital signatures on official documents, contracts, and applications.

>Access to Public Services – Facilitates online interactions with Spanish government portals (e.g., tax agency, social security, and municipal services) without needing in-person visits.

>Convenience & Time-Saving – Eliminates the need for physical paperwork, reducing bureaucracy and allowing 24/7 access to essential services.

>Tax & Administrative Procedures – Enables filing tax returns, obtaining official certificates, and managing business registrations electronically.

Spanish Tax Office Registration

If you are not already registered with the tax office in Spain as then you will need to do this. If you own a property, you should already be registered, however as a non-resident. In either case the registration or updating of status is done by completing form ‘modelo 030’.

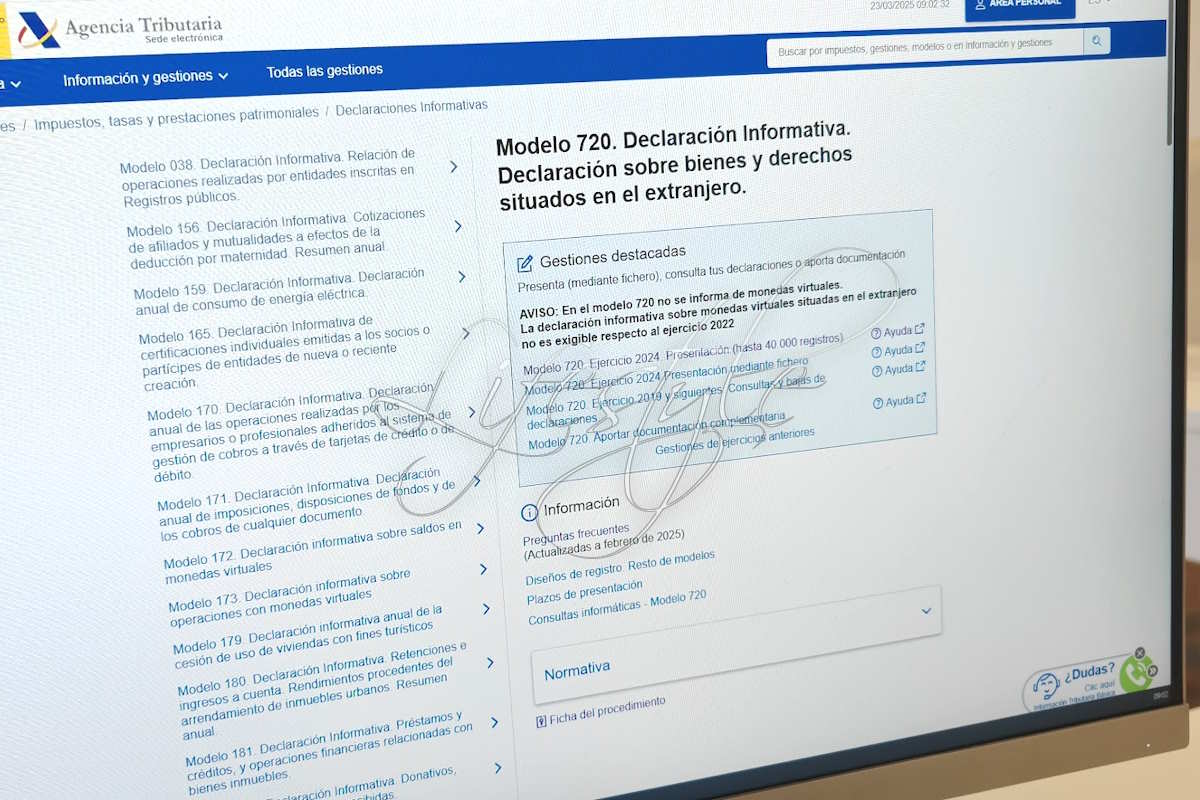

Overseas Assets Declaration – Modelo 720

The Modelo 720 is a mandatory tax form in Spain for tax residents to declare assets held outside Spain if they of value above €50k. If applicable, it has to be completed by 31st March the year after your first tax year in Spain.

Final Non-Residents Tax Return- Modelo 210

New Spanish residentrs who owned property in Spain prior to moving, may need to file a final modelo 210 non-residents tax return.

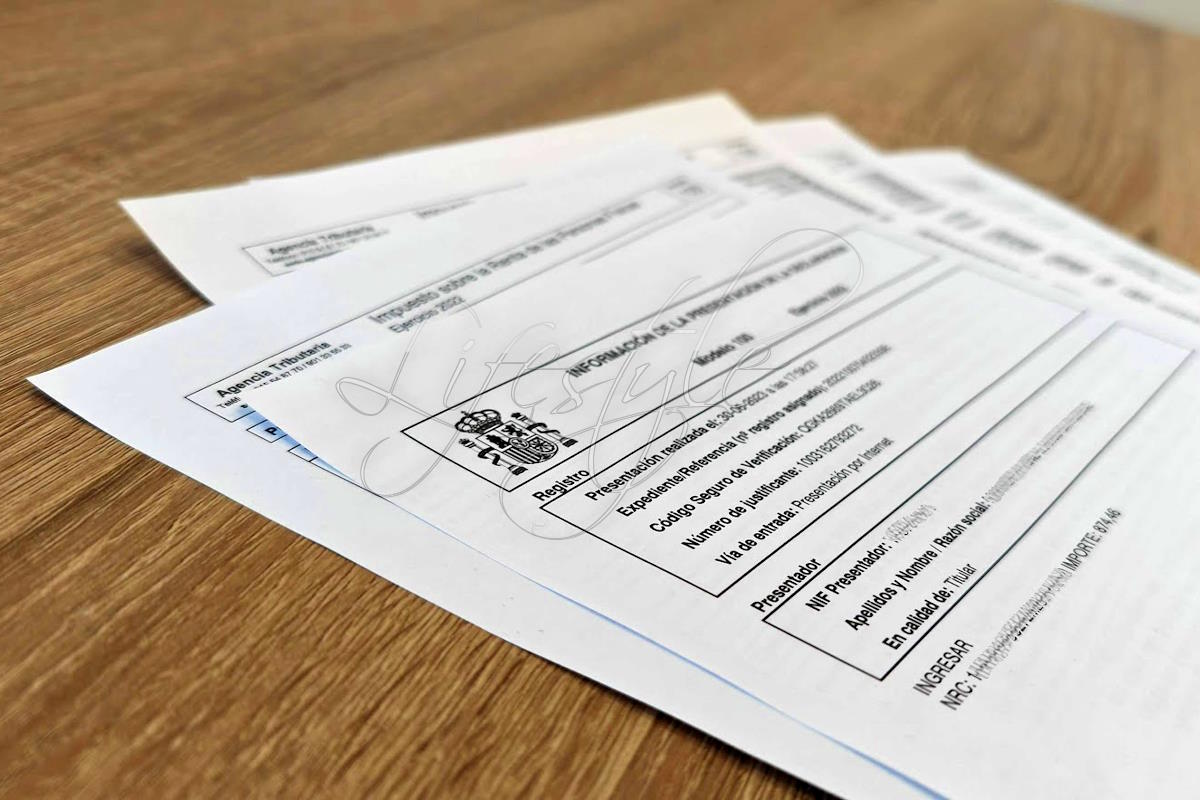

Personal Income Tax Return – Modelo 100

Your first personal income tax return is due the year after you complete your first tax year in Spain. E.g. if you moved in 2024 and spent 183 days in Spain in that year, your first income tax return is due by June 30th 2025. You will need to complete a tax return in Spain if you want to de-register from paying tax in the UK and or make a claim for a refund of tax from HMRC under the double tax agreement.

Double Tax Refund Claim

You will continue to be registered with HMRC as a UK tax payer until you have provided proof that you are now a Spanish tax payer. The proof required is a certificate of fiscal residence issued by the Spanish tax office. This certificate usually cannot be obtained until you have completed your first tax return in Spain,

In many cases there will be a period where you pay tax in both the UK and Spain. Fortunately there is a Double Taxation Agreement (DTA) between the UK and Spain, so if you do pay tax twice you will be able to claim back the tax paid in the UK that you shouldn’t have paid.

The Double Tax Claim Form can be downloaded here.

When you submit or send the form, you’ll need to include the Certificate of Tax Residence in Spain and a copy of your residency certificate / TIE (front and back).

If you need to make a claim for a refund of tax paid in the UK, then you can complete a double tax claim form and send it to HMRC.

https://www.gov.uk/government/publications/double-taxation-united-kingdomspain-si-1976-number-1919-form-spain-individual

The following is a link to the section of the HMRC website that provides information about tax when you’ve left the UK.

https://www.gov.uk/tax-right-retire-abroad-return-to-uk